How to Accelerate Digital Health Innovations

Post Date: September 16, 2025 | Publish Date:

Investors are looking for more than just a great idea

Commercializing a digital health innovation takes more than a breakthrough. It takes evidence, funding and the right partners to deliver solutions to patients and families. That was the message from Claire Smith, partner at SpringTide Ventures, who spoke to Cincinnati Children’s innovators during a recent visit hosted by Cincinnati Children’s Innovation Ventures.

As part of her role at SpringTide, Smith’s team invests in early-stage health tech, life sciences and companies. Smith shared what it takes to move an idea from concept to company and what investors look for along the way.

From Idea to Impact

Smith encouraged innovators to approach commercialization like science itself:

- Test your hypothesis: Identify the problem your product solves and for whom.

- Engage broadly: Beyond physicians, get feedback from nurses, administrators and budget decision-makers early.

- Gather evidence: Collect outcome and cost data, even in pilot projects, to build a business case.“The question isn’t just whether the product works,” Smith said. “It’s whether the people paying for it also see the benefit.”

Funding Pathways

Innovation requires resources, and Smith outlined two broad categories:

- Non-dilutive funding (e.g., grants, partnerships) that brings in money without giving up equity.

- Dilutive funding (e.g., angel or venture capital) that trades ownership for growth capital.

Clarity is critical when approaching investors. She recommends being specific about how much you need, what milestones investments fund, and how the innovation creates value.

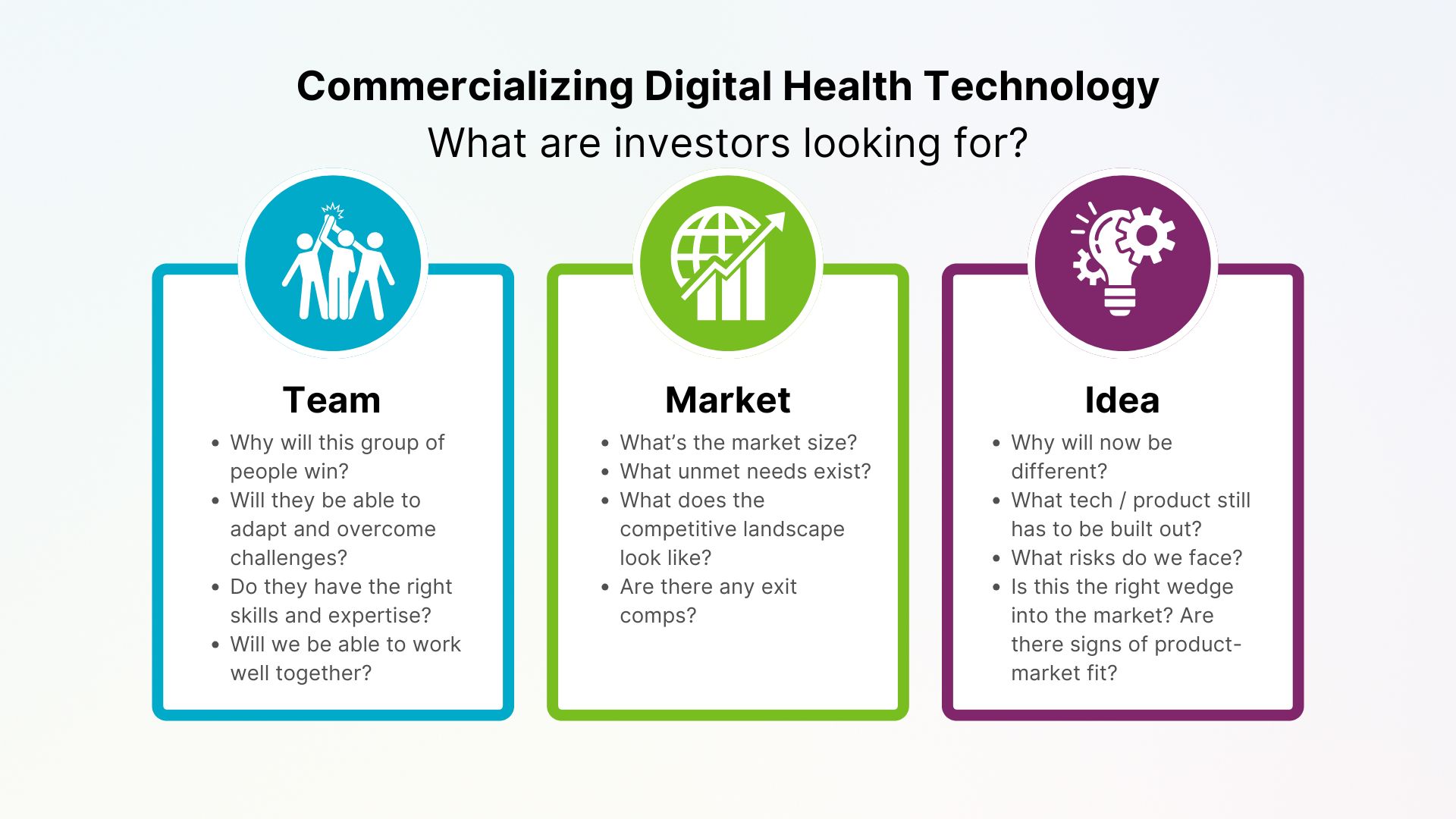

What Investors Want

SpringTide evaluates opportunities on three main factors: the team, the market, and the idea. The team is by far the most important. Investors want to see founders who can execute, adapt and attract strong talent. Trust, honesty and resilience matter more than having a full leadership bench at the earliest stage.

Next is the market. A strong idea won’t succeed without a clear unmet need and a realistic path to adoption. Investors look closely at market size, customer dynamics and integration challenges to assess whether the product can truly gain traction.

Finally comes the idea itself. While the concept is important, execution often makes the difference. As Smith explained, “a B+ idea with A-level execution will beat an A idea with B-level execution every time.”

She added that her own investment decisions come down to three questions: What is the thesis for this investment? Why is now the right time? And can the company deliver the returns investors expect?

Building for Success

Smith urged innovators to be strategic about negotiating ownerships stakes, choosing investors carefully and treating fundraising as a process: “The goal of your first meeting isn’t a check, it’s a second meeting.”

At Cincinnati Children’s, she added, innovators have a unique advantage: access to a world-class network of clinicians, researchers and operational experts. “That ecosystem,” Smith said, “is a superpower.”

Don’t Miss a Post:

- Subscribe to the Research Horizons Newsletter

- Follow Cincinnati Children’s Research Foundation on Bluesky, X and LinkedIn

- Learn more about collaboration opportunities or connect with Cincinnati Children’s innovation team members on the Innovation Ventures website.